Our Process

Turning Experts Into Fund Managers

At Impact Pockets, we work with seasoned operators ready to build a fund, not just raise capital. Our process is selective, strategic, and built to set you up for success from day one.

At Impact Pockets, we work with seasoned operators ready to build a fund, not just raise capital. Our process is selective, strategic, and built to set you up for success from day one.

.png)

Deep dive into your operational and financial history

.png)

Assess market potential and fundability

.png)

Identify red flags and growth levers

Capital Follows Track Record

Great funds are built on great operators but also great preparation. We dig into your business and your operating model, stress test your vision, and identify whether this can scale with investor capital.

Gather investor feedback

.png)

.png)

Gauge appetite and alignment

.png)

Optimize materials based on real world input

You'll know where you stand before a single dollar is raised

.png)

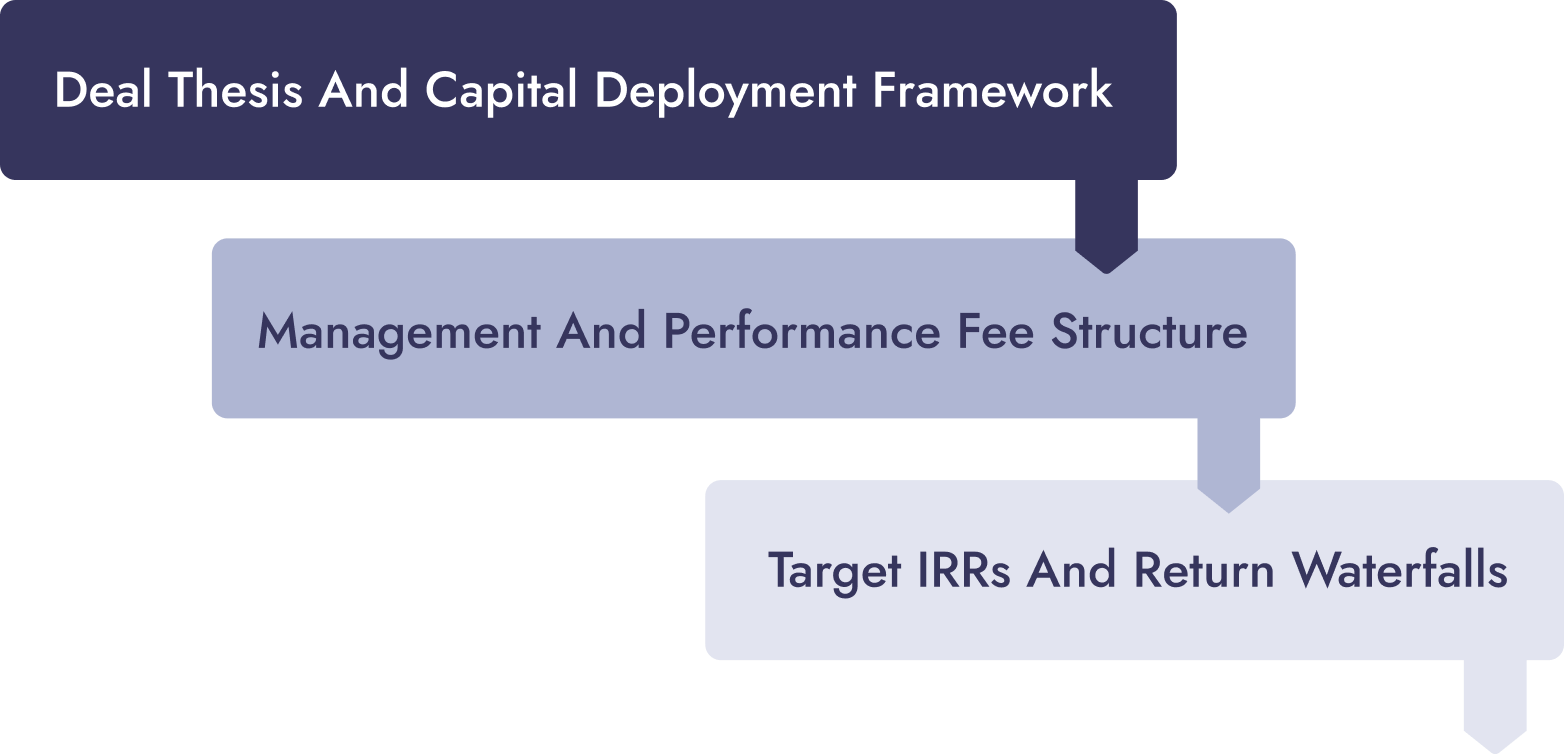

Entity and legal structuring

.png)

Technology and back-office setup (if needed)

.png)

LP agreement drafting

.png)

recruitment services

If Chris or Lane join your management team, additional compensation applies

If we build fund-specific technology, additional compensation applies

We invest time, energy, and reputation because we believe in what we help build